Financial Relief: Students grapple with the cost of college tuition

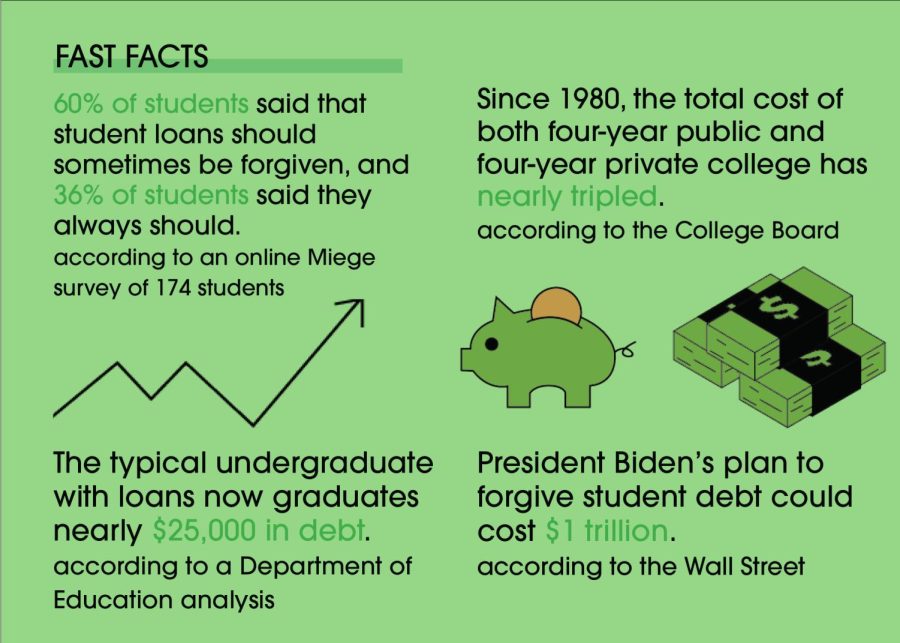

Check out these fast facts about student loan forgiveness and how they affect students today.

October 14, 2022

With the pressure to choose a college looming for upperclassmen, they often face another challenge — paying for it.

Senior Elizabeth Benes has applied for multiple scholarships, worked several babysitting jobs throughout the summer and been involved in numerous activities to improve her resume, but still relates to the pressure of deciding on a college based on the price of tuition.

“I think it’s disappointing when you absolutely love a school, but money is a problem,” Benes said. “It puts a lot of unneeded stress.”

On Aug. 24, President Joe Biden announced a historic student loan forgiveness plan that allows loan borrowers with the Department of Education up to $10,000 if they make less than $125,000. If they also received Pell Grants, borrowers are eligible for up to $20,000. If an individual has less than $10,000 in student debt, they will receive their exact amount back as part of the forgiveness plan.

“College is expensive and I think no matter how much parents make, any forgiveness of loans is highly acceptable for our students,” guidance counselor Elaine Schmidtberger said.

According to the Washington Post, about one in five Americans hold student loans, but Schmidtberger said attending college is still worth it.

“Having a four year degree, no matter what the major, is going to pay off,” Schmidtberger said.

English teacher Brock Hess graduated from college two years ago and relates to the stress that the expense of college can bring.

“I was terrified about picking a college because it was so expensive, and money was always a big stressor for me,” Hess said. “I thought it would be a year-by-year thing to see how many years I could afford.”

According to the National Public Radio, there will be an application available in early October for individuals to receive their loan forgiveness. It is recommended that applicants submit their forms before Nov. 15, so the Education Department can go through the applications before the student loan payment pause ends on Dec. 31. Applications are expected to take four to six weeks to process from the initial day they are submitted.

“I think [student loan forgiveness] will help a lot by relieving the financial burden because student loans are something that almost everyone has,” Hess said. “They are a weight on your shoulders that you feel like you can not get on top of, until you are free of them.”

According to an online survey of 177 responses, 59% of students said that they may use student loans, while 24% said they definitely will. Schmidtberger cautions students about the effects of student loans and suggests that, if eligible, students should first look into merit aid scholarships.

“I think seniors think they’ll go to college, they’ll take out a loan and it will be easy to repay it,” Schmidtberger said. “They don’t realize the higher interest rates on certain loans.”

As seniors begin applying to colleges, it is still uncertain if President Biden’s student loan forgiveness plan will apply to future college students.

“If [Biden’s student loan forgiveness plan] does affect us, that would be great because then people could go to their dream college and college can be exciting, rather than worrying about student debt,” Benes said. “You could go where you want to, rather than where you can afford.”